Researches By Investment cases

Nvidia has surpassed Alphabet in market capitalization, following closely after its recent overtaking of Amazon. Nvidia is now the fourth most valuable company in the world. According to Bloomberg, the chip manufacturer's stock now stands at $1.83 trillion in value, edging out Alphabet's market cap of $1.82 trillion. This achievement positions Nvidia as the fourth most valuable company globally amidst the AI surge, trailing behind Microsoft ($3.04T), Apple ($2.84T), and Saudi Aramco.

Topic: Financials

Publication Type: Investment Cases

Nvidia's Market Value Surpasses Amazon and Google

19 February, 2024 | GraniteShares

Nvidia has surpassed Alphabet in market capitalization, following closely after its recent overtaking of Amazon. Nvidia is now the fourth most valuable company in the world. According to Bloomberg, the chip manufacturer's stock now stands at $1.83 trillion in value, edging out Alphabet's market cap of $1.82 trillion. This achievement positions Nvidia as the fourth most valuable company globally amidst the AI surge, trailing behind Microsoft ($3.04T), Apple ($2.84T), and Saudi Aramco.

As we bid our farewell to 2023, it's an opportune moment to ponder upon the key elements that shaped the financial markets throughout the year. With December 2023, gains for S&P 500 index exceeding 4%, the S&P 500 index ended the year with an impressive total return of over 26%, poised on the verge of reaching new all-time highs.

Topic: Industrials

Publication Type: Investment Cases , Updates , Articles

GraniteShares' Top-Performing Leveraged ETPs: A 2023 Review

17 January, 2024 | GraniteShares

As we bid our farewell to 2023, it's an opportune moment to ponder upon the key elements that shaped the financial markets throughout the year. With December 2023, gains for S&P 500 index exceeding 4%, the S&P 500 index ended the year with an impressive total return of over 26%, poised on the verge of reaching new all-time highs.

After Two years of delay, Tesla's Cybertruck officially entered the electric pickup truck market to compete with well-established companies like Rivian Automotive's R1T, Ford's F150 Lightning, and General Motors' Hummer EV. Tesla (TSLA) has planned to begin its cybertruck pickup to customers from Thursday, November 30.

Topic: Industrials , Technology , FATANG

Publication Type: Investment Cases , Articles , ETP and Industry

From Concept to Reality: Tesla Cybertruck is Set to Debut

02 December, 2023 | GraniteShares

After Two years of delay, Tesla's Cybertruck officially entered the electric pickup truck market to compete with well-established companies like Rivian Automotive's R1T, Ford's F150 Lightning, and General Motors' Hummer EV. Tesla (TSLA) has planned to begin its cybertruck pickup to customers from Thursday, November 30.

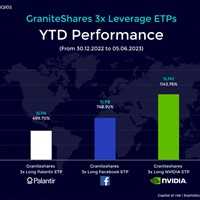

GraniteShares, a leading provider of leveraged exchange-traded products (ETPs), has been making waves in the market with its innovative offerings. Among their standout performers are the GraniteShares 3x Long ETPs, designed to provide three times the daily performance of popular tech stocks. Year to date, these ETPs have delivered exceptional returns, with a particular focus on industry giants such as NVIDIA, Facebook, and Palantir. Examining the data can help us better understand why so many investors are drawn to these high-growth possibilities.

Topic: Financials

Publication Type: Investment Cases , ETP and Industry

GraniteShares 3x Long ETPs YTD Performance Soars

08 June, 2023 | GraniteShares

GraniteShares, a leading provider of leveraged exchange-traded products (ETPs), has been making waves in the market with its innovative offerings. Among their standout performers are the GraniteShares 3x Long ETPs, designed to provide three times the daily performance of popular tech stocks. Year to date, these ETPs have delivered exceptional returns, with a particular focus on industry giants such as NVIDIA, Facebook, and Palantir. Examining the data can help us better understand why so many investors are drawn to these high-growth possibilities.

How To Short Tesla Stock? Shorting Tesla stock, or Tesla short selling, is a type of investment strategy that many experienced traders repeatedly use. Investors borrow stock from their broker’s inventory and promise to return them once short selling has finished. It usually works as follows:

Topic: Technology

Publication Type: Investment Cases , Investments , Single stock research

How To Short Tesla Stock

09 March, 2023 | GraniteShares

How To Short Tesla Stock? Shorting Tesla stock, or Tesla short selling, is a type of investment strategy that many experienced traders repeatedly use. Investors borrow stock from their broker’s inventory and promise to return them once short selling has finished. It usually works as follows:

Earning season is the time of the year when publicly traded companies release their quarterly or annual earnings by the end of each quarter. These reports by the companies include information about the earnings, revenue and expenses. Earnings reports give investors access to the company’s actual performance from the previous three months. There are rules regarding the deadlines by which the companies need to file and report their earnings. Companies can schedule the release on a day that benefits them.

Topic: Financials , Industrials , Technology

Publication Type: Investment Cases , Articles

Everything you need to know about Earnings Season

10 November, 2022 | GraniteShares

Earning season is the time of the year when publicly traded companies release their quarterly or annual earnings by the end of each quarter. These reports by the companies include information about the earnings, revenue and expenses. Earnings reports give investors access to the company’s actual performance from the previous three months. There are rules regarding the deadlines by which the companies need to file and report their earnings. Companies can schedule the release on a day that benefits them.

The automotive giant became the first to launch and adopt an electric vehicle. The company recently announced its first-quarter earnings for 2022. The revenue increased by 81% and operating profits were up by 137% (Source: Tesla investor relations). Even with stable earnings for the company the stock had been volatile, increasing 5% when the results were announced and later it plunged.

Topic: Technology

Publication Type: Investment Cases , Investments , Single stock research

Leveraging Tesla using ETPs

26 May, 2022 | GraniteShares

The automotive giant became the first to launch and adopt an electric vehicle. The company recently announced its first-quarter earnings for 2022. The revenue increased by 81% and operating profits were up by 137% (Source: Tesla investor relations). Even with stable earnings for the company the stock had been volatile, increasing 5% when the results were announced and later it plunged.

Check out this article for information about Leveraging Apple Stock safely and a groundbreaking firm that will help you expand your investment portfolio with little hassle.

Topic: Technology

Publication Type: Investment Cases , Investments , Single stock research

Apple Leverage Shares

18 May, 2022 | GraniteShares

Check out this article for information about Leveraging Apple Stock safely and a groundbreaking firm that will help you expand your investment portfolio with little hassle.

Analysis of industry data by ETF provider GraniteShares reveals that 16 FTSE 100 companies have annual dividend yields – these are based on the current share price and the total dividends declared in the previous 12 months - of 0%.

Topic: Telecoms , Financials , Basic Materials , Energy , Healthcare , Industrials , Consumer Staples , Technology

Publication Type: Investment Cases , Investments

Poor Dividend Yields in FTSE 100 & 250: Analysis

13 May, 2021 | GraniteShares

Analysis of industry data by ETF provider GraniteShares reveals that 16 FTSE 100 companies have annual dividend yields – these are based on the current share price and the total dividends declared in the previous 12 months - of 0%.

In this article, we focus on investing in the FTSE 100, the UK index of blue chip stocks, by providing you with information about what it is, how to invest in it, the risks and the benefits, and also ways that sophisticated investors can act tactically around stocks in the index.

GraniteShares is focused on delivering innovative and cutting edge investment solutions for sophisticated investors.

Topic: Financials

Publication Type: Investment Cases , Investments

How to Invest in FTSE 100 in the United Kingdom

15 December, 2020 | GraniteShares

In this article, we focus on investing in the FTSE 100, the UK index of blue chip stocks, by providing you with information about what it is, how to invest in it, the risks and the benefits, and also ways that sophisticated investors can act tactically around stocks in the index.

GraniteShares is focused on delivering innovative and cutting edge investment solutions for sophisticated investors.

In this blog, we consider how investors can take exposure to property as an asset class by investing in either open-ended or closed-end funds. It is likely that physically-owned property is one of the biggest single investments that many investors will make, indeed there are some who will have additional exposure through the ownership of rental properties and/or second homes. We are not going to look at direct property purchases, which typically involves taking on some form of borrowing via a mortgage, possibly the most common way individuals make use of leverage in their lives.

Topic: Basic Materials

Publication Type: Investment Cases , Investments

How to Invest in Real Estate

13 October, 2020 | GraniteShares

In this blog, we consider how investors can take exposure to property as an asset class by investing in either open-ended or closed-end funds. It is likely that physically-owned property is one of the biggest single investments that many investors will make, indeed there are some who will have additional exposure through the ownership of rental properties and/or second homes. We are not going to look at direct property purchases, which typically involves taking on some form of borrowing via a mortgage, possibly the most common way individuals make use of leverage in their lives.

In this blog, we look at gold and how investors can access it through Exchange Traded Funds (ETFs) and Exchange Traded Commodities (ETCs) to include in their investment portfolios. The reason why gold holds appeal for investors is that is a store of value that can provide protection both against inflation and also as a diversifier in a portfolio made up of equities and bonds. In an environment when inflation has been at historically low levels, it is generally for this latter reason that investors will look to include gold in a portfolio.

Topic:

Publication Type: Investment Cases , Investments

How to Invest in Gold

05 October, 2020 | GraniteShares

In this blog, we look at gold and how investors can access it through Exchange Traded Funds (ETFs) and Exchange Traded Commodities (ETCs) to include in their investment portfolios. The reason why gold holds appeal for investors is that is a store of value that can provide protection both against inflation and also as a diversifier in a portfolio made up of equities and bonds. In an environment when inflation has been at historically low levels, it is generally for this latter reason that investors will look to include gold in a portfolio.